2025 Australian Tax Calendar: Key Dates and Deadlines

Related Articles: 2025 Australian Tax Calendar: Key Dates and Deadlines

- Hebrew Calendar: April 13, 2029

- 7-Day Calendar Template 2025: A Comprehensive Guide For Effective Time Management

- 2025 Luxembourg Calendar: A Comprehensive Guide To Public Holidays, Notable Dates, And Observances

- Peel District School Board (PDSB) 2025-2026 School Year Calendar

- Okaloosa County School District 2020-2021 School Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Australian Tax Calendar: Key Dates and Deadlines. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Australian Tax Calendar: Key Dates and Deadlines

2025 Australian Tax Calendar: Key Dates and Deadlines

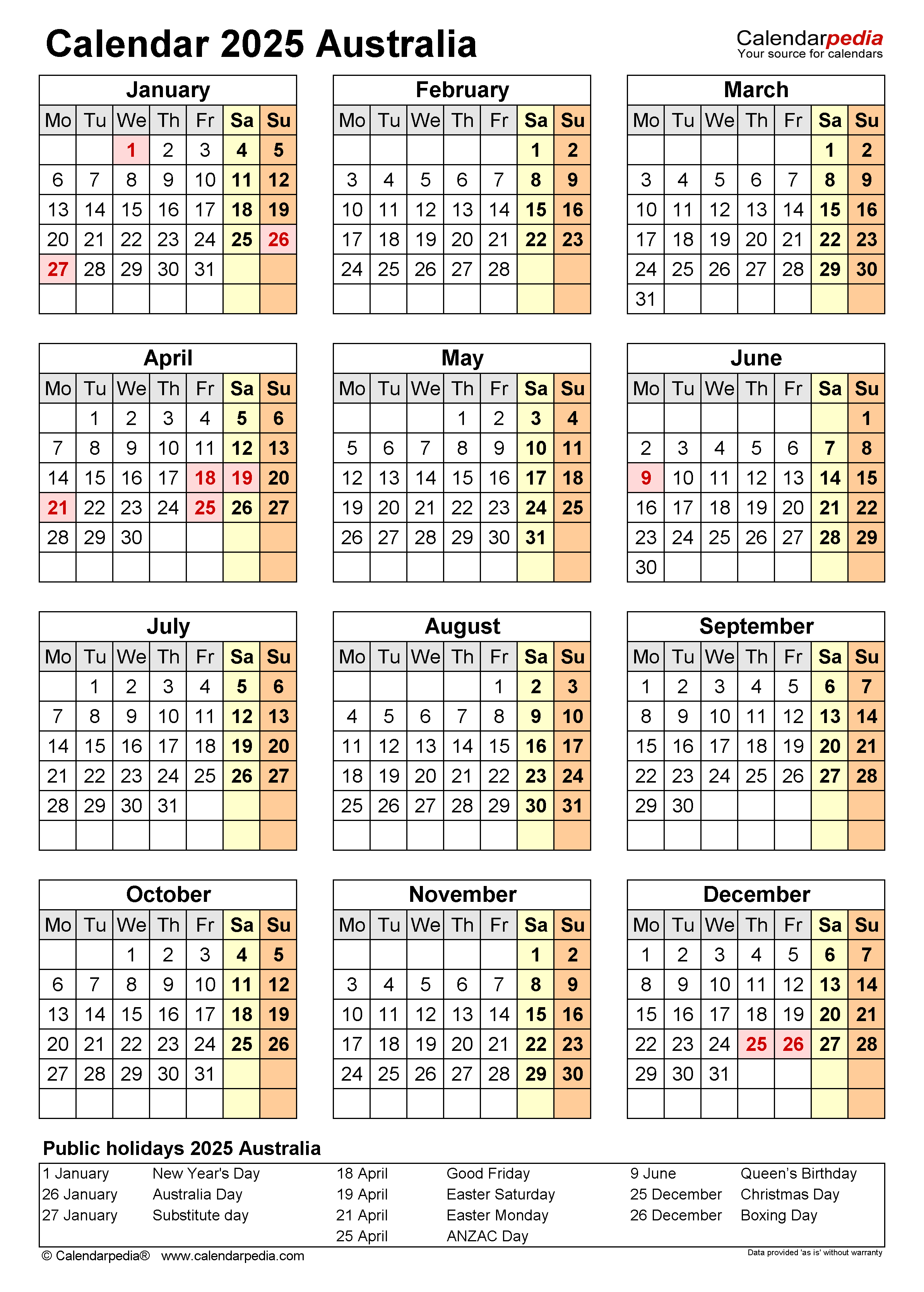

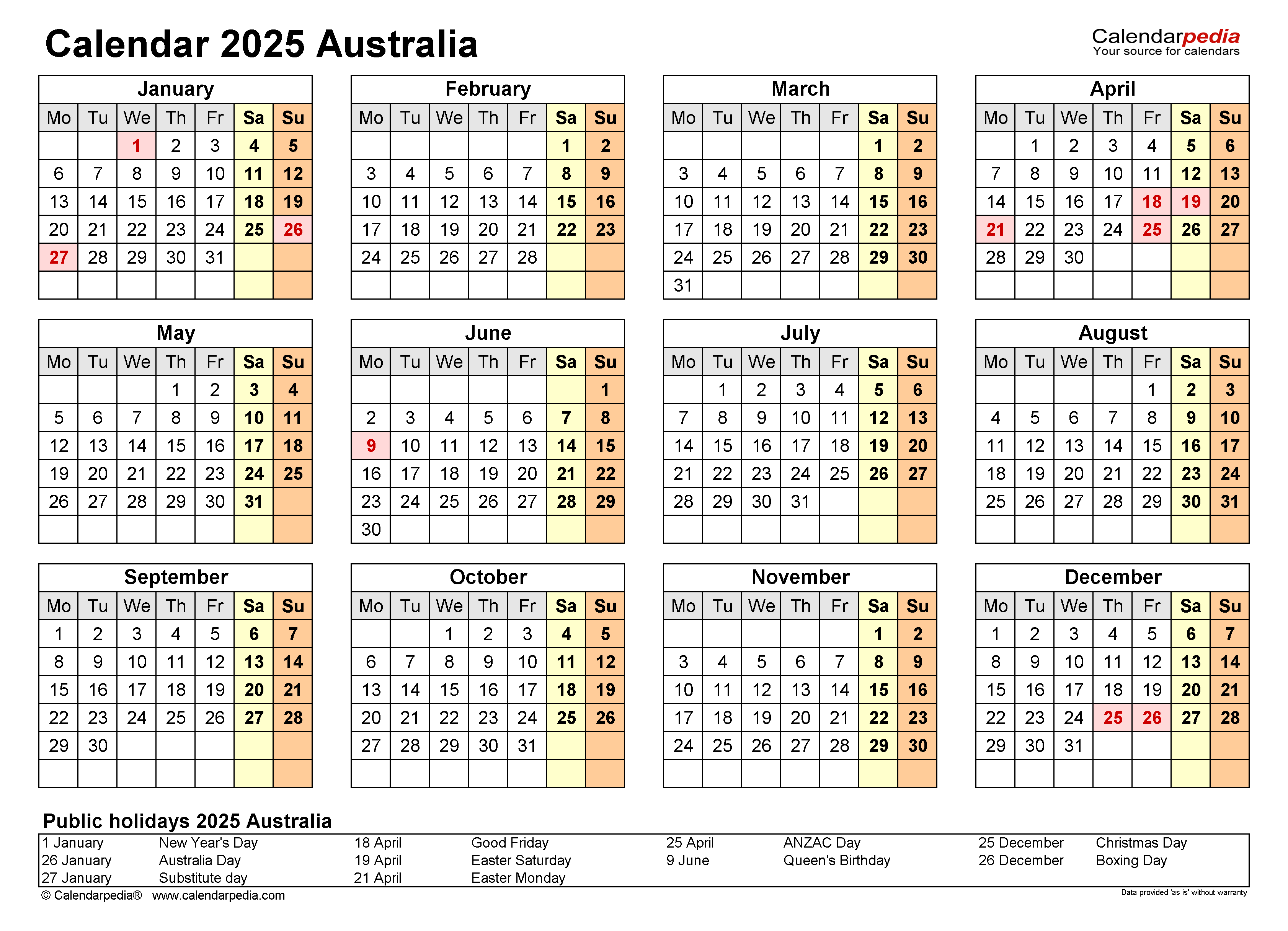

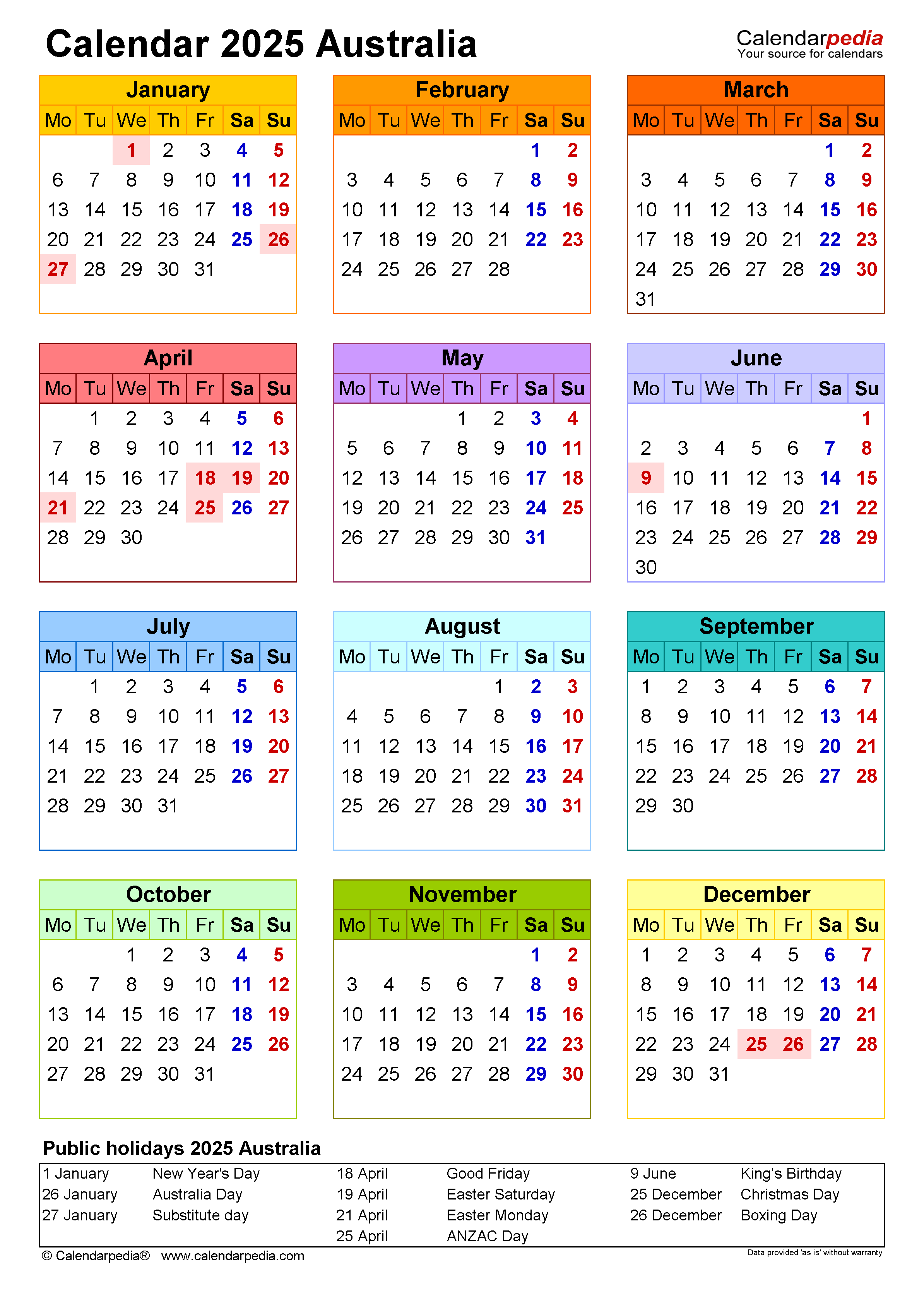

The Australian Taxation Office (ATO) has released the 2025 tax calendar, outlining important dates and deadlines for individuals and businesses to meet their tax obligations. Understanding these deadlines is crucial to avoid penalties and ensure timely compliance. Here’s a comprehensive overview of the key dates in the 2025 Australian tax calendar:

January

- 1 January 2025: New Year’s Day (public holiday)

- 15 January 2025: Due date for activity statements for the December 2024 quarter (for businesses with an annual turnover of $10 million or more)

February

- 28 February 2025: Due date for individual income tax returns for the 2024 financial year

- 28 February 2025: Due date for lodgement of business income tax returns for the 2024 financial year

- 28 February 2025: Due date for lodgement of trust income tax returns for the 2024 financial year

March

- 15 March 2025: Due date for activity statements for the January 2025 quarter (for businesses with an annual turnover of $10 million or more)

- 31 March 2025: Deadline for making superannuation contributions for the 2024-2025 financial year to claim a tax deduction

April

- 15 April 2025: Due date for activity statements for the February 2025 quarter (for businesses with an annual turnover of $10 million or more)

May

- 15 May 2025: Due date for activity statements for the March 2025 quarter (for businesses with an annual turnover of $10 million or more)

June

- 30 June 2025: End of the 2024-2025 financial year

July

- 15 July 2025: Due date for activity statements for the April 2025 quarter (for businesses with an annual turnover of $10 million or more)

August

- 15 August 2025: Due date for activity statements for the May 2025 quarter (for businesses with an annual turnover of $10 million or more)

September

- 15 September 2025: Due date for activity statements for the June 2025 quarter (for businesses with an annual turnover of $10 million or more)

October

- 15 October 2025: Due date for activity statements for the July 2025 quarter (for businesses with an annual turnover of $10 million or more)

November

- 15 November 2025: Due date for activity statements for the August 2025 quarter (for businesses with an annual turnover of $10 million or more)

December

- 15 December 2025: Due date for activity statements for the September 2025 quarter (for businesses with an annual turnover of $10 million or more)

- 25 December 2025: Christmas Day (public holiday)

Additional Key Dates:

Payment Due Dates for Individuals:

- 21 July 2025: Payment due date for individuals who lodged their income tax return by 31 October 2024

- 21 August 2025: Payment due date for individuals who lodged their income tax return after 31 October 2024

Payment Due Dates for Businesses:

- 28 February 2025: Payment due date for businesses that lodged their income tax return by 15 May 2024

- 28 March 2025: Payment due date for businesses that lodged their income tax return after 15 May 2024

Important Notes:

- These deadlines apply to individuals and businesses who are required to lodge their tax returns and activity statements with the ATO.

- The due dates may vary for certain circumstances, such as public holidays or weekends.

- It’s recommended to mark these dates in your calendar and plan ahead to avoid any penalties or late fees.

- The ATO provides various resources and support to assist taxpayers in meeting their obligations.

Conclusion:

The 2025 Australian tax calendar provides a comprehensive overview of key dates and deadlines for taxpayers. By understanding these deadlines, individuals and businesses can ensure timely compliance and avoid potential penalties. It’s important to stay informed about any changes or updates to the tax calendar, as the ATO may make adjustments from time to time. The ATO website and other official channels are valuable sources of information for taxpayers.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Closure

Thus, we hope this article has provided valuable insights into 2025 Australian Tax Calendar: Key Dates and Deadlines. We thank you for taking the time to read this article. See you in our next article!