2025 Fiscal Year Calendar: A Comprehensive Guide

Related Articles: 2025 Fiscal Year Calendar: A Comprehensive Guide

- Holiday Calendar 2025-2026: A Comprehensive Guide To Federal Holidays

- Printable Calendar 2025 Yearly: A Comprehensive Guide To Planning Your Year

- May Calendar 2025 Printable Free

- Mead Planner 2025 – 2025 Year Calendar Cat: The Purr-fect Companion For Organized Feline Enthusiasts

- West Bengal Government Calendar 2025: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Fiscal Year Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Fiscal Year Calendar: A Comprehensive Guide

2025 Fiscal Year Calendar: A Comprehensive Guide

Introduction

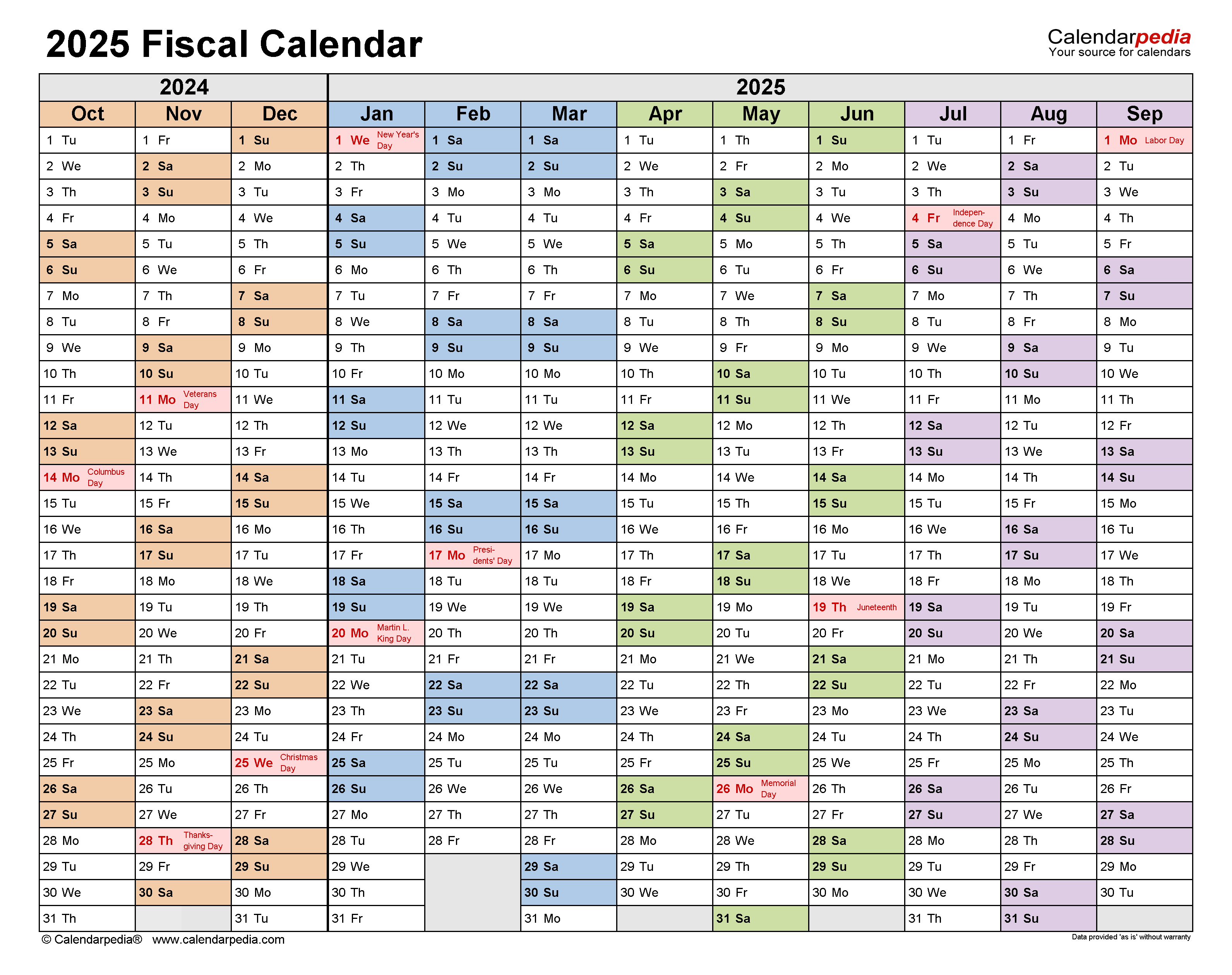

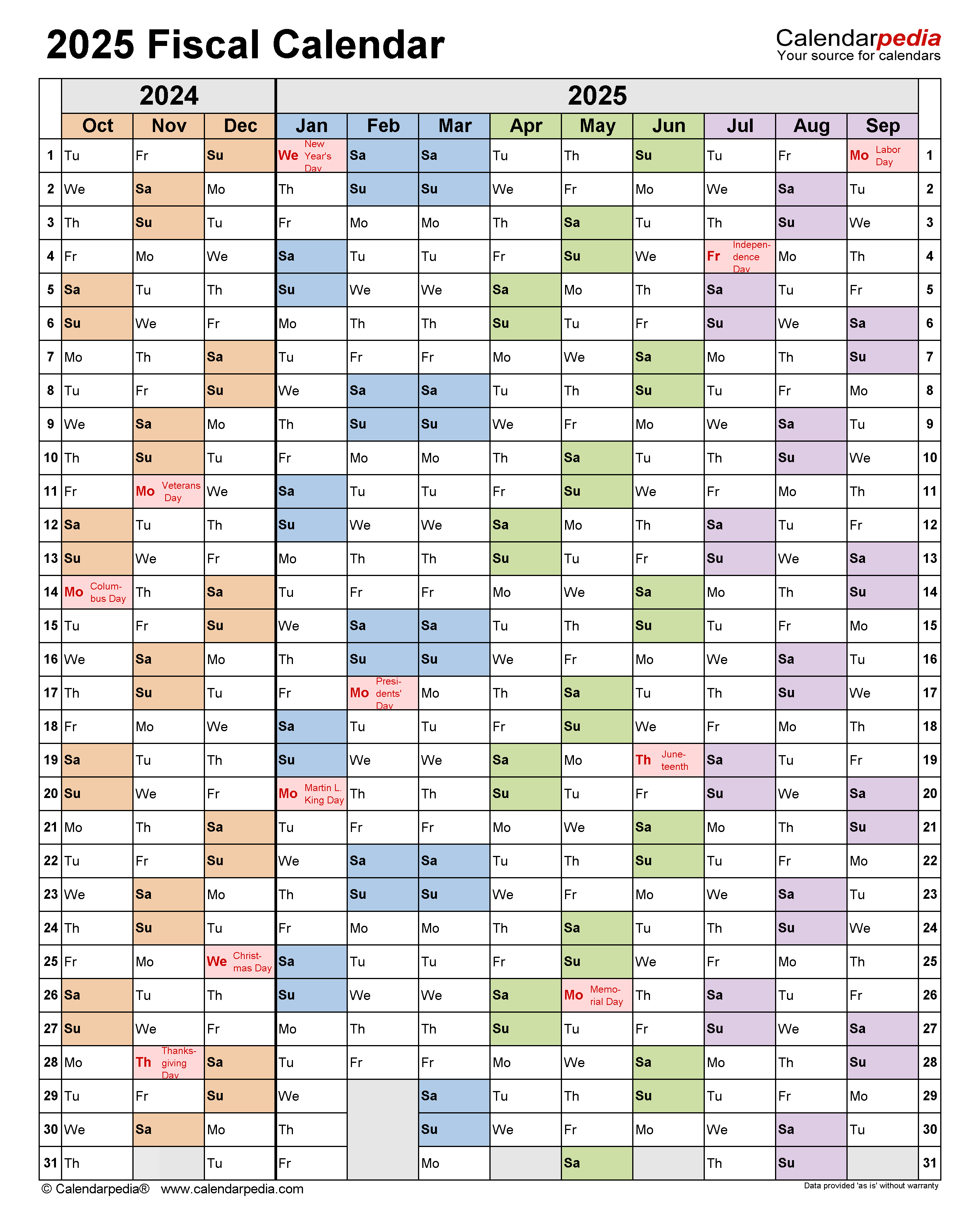

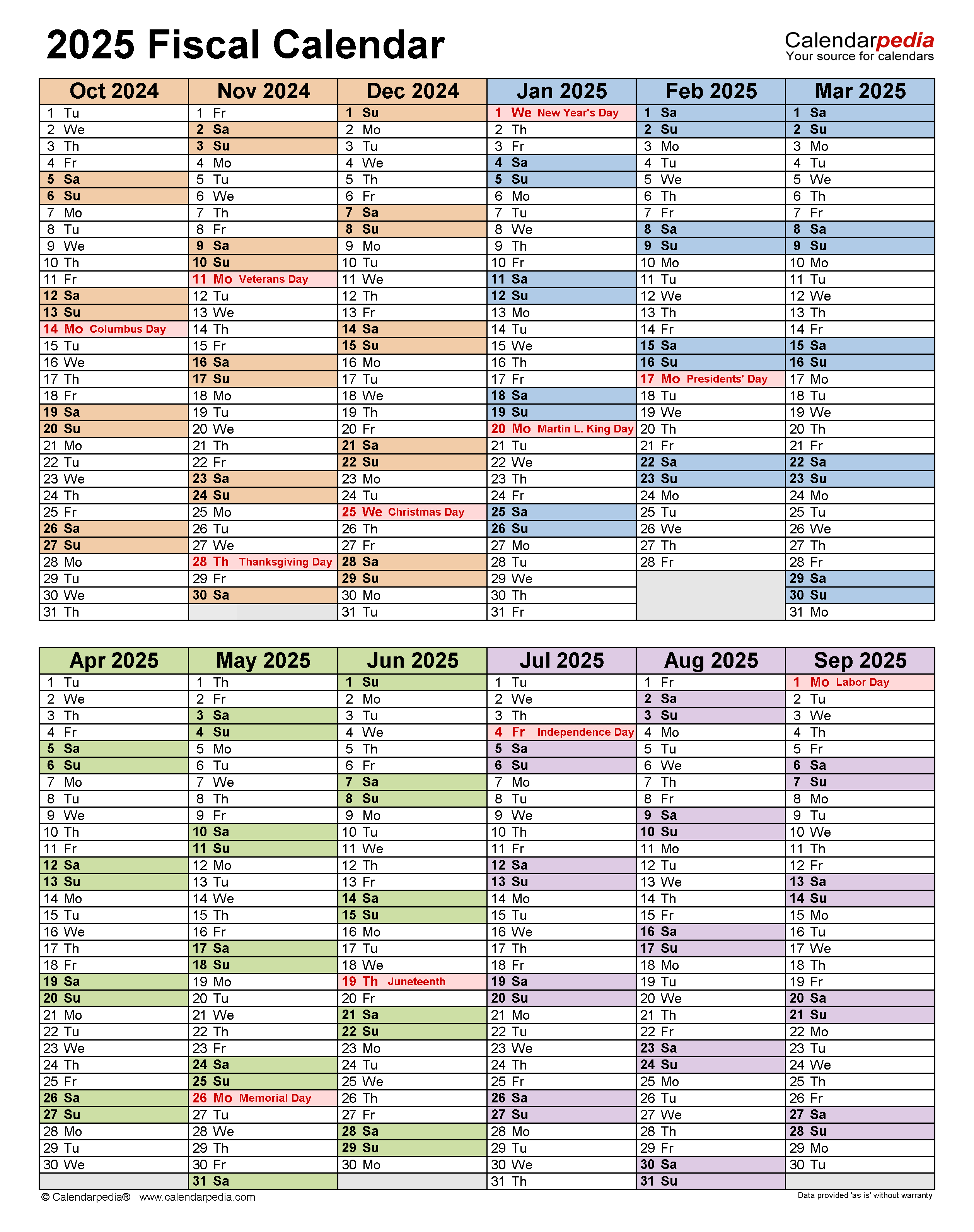

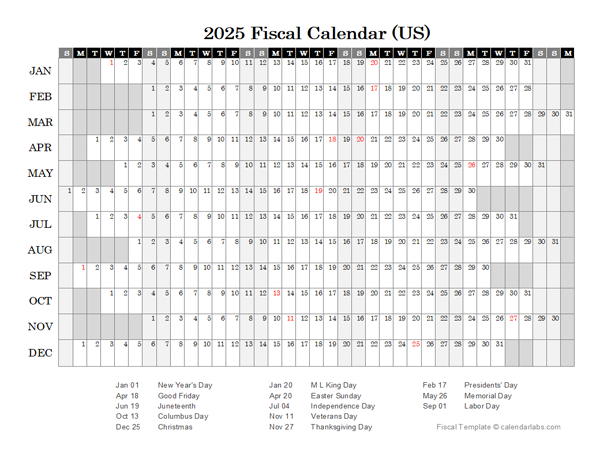

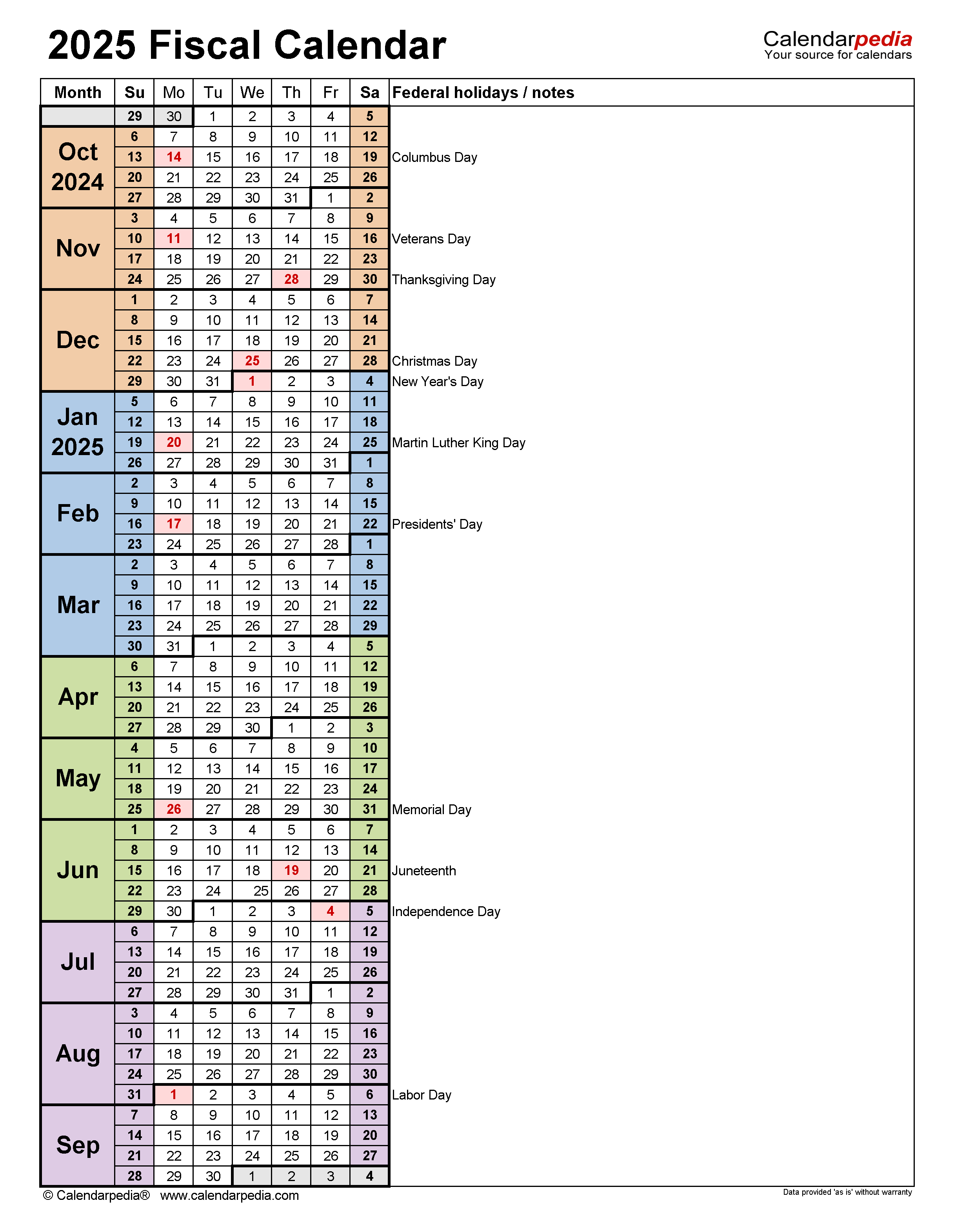

The fiscal year (FY) is a 12-month period used by businesses, governments, and other organizations to track financial performance and plan for future operations. The 2025 fiscal year begins on October 1, 2024, and ends on September 30, 2025. This article provides a comprehensive guide to the 2025 fiscal year calendar, including key dates, deadlines, and holidays.

Key Dates

The following are key dates in the 2025 fiscal year:

- October 1, 2024: Beginning of the 2025 fiscal year

- October 31, 2024: Deadline for submitting quarterly tax returns

- January 15, 2025: Deadline for submitting annual tax returns

- March 15, 2025: Deadline for submitting quarterly tax returns

- June 15, 2025: Deadline for submitting quarterly tax returns

- September 30, 2025: End of the 2025 fiscal year

Deadlines

The following are important deadlines to keep in mind during the 2025 fiscal year:

-

Tax deadlines: Businesses and individuals must file their tax returns by the following deadlines:

- October 31, 2024: Quarterly tax return for Q3 2024

- January 15, 2025: Annual tax return for 2024

- March 15, 2025: Quarterly tax return for Q4 2024

- June 15, 2025: Quarterly tax return for Q1 2025

-

Financial reporting deadlines: Public companies must file their financial reports with the Securities and Exchange Commission (SEC) by the following deadlines:

- November 14, 2024: Form 10-Q for Q3 2024

- February 13, 2025: Form 10-K for 2024

- May 12, 2025: Form 10-Q for Q1 2025

- August 11, 2025: Form 10-Q for Q2 2025

Holidays

The following are federal holidays observed during the 2025 fiscal year:

- October 14, 2024: Columbus Day

- November 11, 2024: Veterans Day

- November 28, 2024: Thanksgiving Day

- December 25, 2024: Christmas Day

- January 1, 2025: New Year’s Day

- January 20, 2025: Martin Luther King Jr. Day

- February 17, 2025: Presidents Day

- May 26, 2025: Memorial Day

- June 19, 2025: Juneteenth

- July 4, 2025: Independence Day

- September 1, 2025: Labor Day

Planning for the 2025 Fiscal Year

Businesses and organizations should begin planning for the 2025 fiscal year well in advance. This includes setting financial goals, developing a budget, and forecasting revenue and expenses. It is also important to review the key dates and deadlines for the fiscal year to ensure compliance with all applicable regulations.

Conclusion

The 2025 fiscal year calendar provides a roadmap for businesses and organizations to track financial performance and plan for future operations. By understanding the key dates, deadlines, and holidays, businesses can effectively manage their finances and achieve their business objectives.

Closure

Thus, we hope this article has provided valuable insights into 2025 Fiscal Year Calendar: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!